Understanding Low Monthly Income

Definition and Criteria for Low Monthly Income

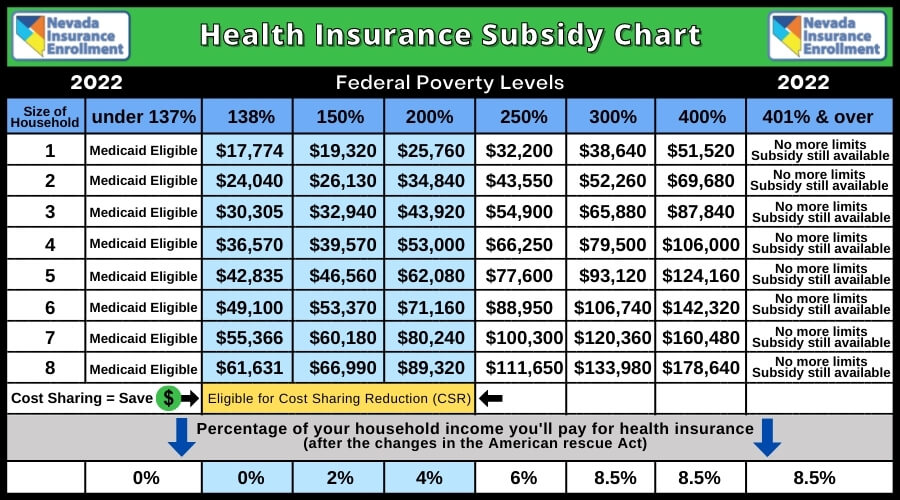

Low monthly income refers to the amount of money earned by individuals or households that falls below a certain predetermined level. This level is known as the federal poverty level (FPL) and is set by the government to determine eligibility for various assistance programs.

The FPL is calculated based on the size of the household and takes into account the number of individuals residing in it. For example, in 2023, the FPL for a single-person household is $14,580 annually, while for a four-person household, it is $30,000 per year. These values are applicable in the 48 contiguous states and the District of Columbia, with separate guidelines for Alaska and Hawaii due to the higher cost of living in those states.

To qualify as low income, individuals or families must have a monthly income that is below the FPL threshold. This means that their earnings are insufficient to meet basic needs such as food, housing, healthcare, and other essential expenses.

Federal Guidelines for Low Income

Several federal programs use the FPL definition of low income to determine eligibility for assistance. These programs aim to provide support and resources to individuals and families in need. Some of the significant programs that rely on the FPL definition include:

1. Head Start: This program offers early childhood education, health, and nutrition services to low-income children and their families. By using the FPL criteria, Head Start ensures that children from economically disadvantaged backgrounds receive the necessary support for their overall development.

2. Supplemental Nutrition Assistance Program (SNAP): Formerly known as food stamps, SNAP provides eligible low-income individuals and families with funds to purchase food. The program utilizes the FPL guidelines to determine the amount of assistance a household can receive based on their income level.

3. Medicaid: Medicaid is a health insurance program that helps low-income individuals and families access essential medical services. The FPL criteria are used to determine eligibility for Medicaid, ensuring that those who cannot afford private health insurance can receive the necessary healthcare coverage.

4. Low-Income Home Energy Assistance Program (LIHEAP): LIHEAP provides financial assistance to eligible low-income households to help them pay for heating and cooling costs. The program uses the FPL guidelines to determine the level of support individuals or families can receive based on their income and household size.

5. Federal Pell Grant: The Federal Pell Grant is a need-based financial aid program for students pursuing higher education. The FPL criteria are utilized to assess an applicant’s eligibility and determine the amount of grant they can receive to cover their educational expenses.

These programs and many others rely on the FPL definition of low income to ensure that support reaches those who need it the most. The FPL acts as a benchmark to identify individuals and families who are struggling financially and require assistance to improve their quality of life.

The Impact of Low Monthly Income

Challenges Faced by Low-Income Earners

Low monthly income can have various challenges and impacts on individuals and families. Here are some of the challenges faced by low-income earners:

1. Financial Strain: With limited income, low-income earners often struggle to meet their basic needs such as food, shelter, and healthcare. They may find it difficult to pay rent, utilities, or afford essential medical expenses.

2. Limited Opportunities for Education and Career Growth: Low-income individuals may face barriers to accessing quality education and training opportunities. This can limit their potential for career advancement and higher-paying jobs, trapping them in a cycle of low-income jobs.

3. Increased Stress and Mental Health Issues: The constant worry and stress of living on a low income can have a significant impact on mental health. Financial strain can lead to anxiety, depression, and other mental health issues.

4. Inadequate Healthcare Access: Low-income earners may struggle to afford health insurance or face limited access to healthcare services. This can result in delayed or inadequate medical care, impacting their overall well-being.

5. Limited Social Mobility: Due to financial constraints, low-income individuals often have limited opportunities for upward social mobility. This can perpetuate generational poverty and make it difficult to break the cycle of low income.

Meeting Basic Needs on a Low Monthly Income

When living on a low monthly income, it becomes crucial to prioritize and find ways to meet basic needs. Here are some strategies to help individuals and families on a low income:

1. Budgeting and Financial Planning: Creating a budget and tracking expenses can help individuals manage their limited income effectively. It is essential to prioritize essential needs such as housing, food, and healthcare while cutting back on discretionary expenses.

2. Accessing Government Assistance Programs: Low-income earners can take advantage of government assistance programs like the Supplemental Nutrition Assistance Program (SNAP), Medicaid, and housing assistance. These programs can provide much-needed support to help meet basic needs.

3. Seeking Community Resources: Local community organizations and non-profit agencies often offer assistance in areas such as food banks, utility bill payment assistance, and free or low-cost healthcare services. Connecting with these resources can help supplement the limited income.

4. Building Skills and Education: Investing in education and skill-building can improve career prospects and increase earning potential. Individuals can explore scholarships, grants, and vocational programs to gain qualifications that can lead to better job opportunities.

5. Exploring Supplemental Income Sources: Low-income earners can explore opportunities for supplemental income, such as part-time jobs, freelancing, or starting a small business. These additional sources of income can help improve financial stability.

In conclusion, low monthly income can have significant impacts on individuals and families, posing challenges in meeting basic needs, limited opportunities for education and career advancement, increased stress, and limited social mobility. However, with careful budgeting, accessing government programs, utilizing community resources, investing in education, and exploring supplemental income sources, individuals can work towards improving their financial situation and meeting their basic needs effectively.

Programs and Benefits for Low-Income Individuals

Available Assistance Programs

Low-income individuals and families can avail themselves of various government assistance programs to help meet their basic needs and improve their financial situation. Here are some of the programs available:

1. Head Start: This program provides early childhood education, health, and nutrition services to low-income children and their families. It aims to ensure that children from low-income backgrounds have access to quality educational experiences, promoting their overall development.

2. Low Income Home Energy Assistance Program (LIHEAP): LIHEAP helps eligible low-income households with their home energy costs. It provides financial assistance to help pay energy bills, prevent utility disconnections, and weatherize homes to make them more energy-efficient and affordable.

3. Supplemental Nutrition Assistance Program (SNAP): SNAP assists eligible low-income individuals and families with the purchase of food. Participants receive an electronic benefit transfer (EBT) card that can be used to buy eligible food items at authorized retailers, including grocery stores and farmers markets.

4. Medicaid: Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families. Eligibility varies by state, but it generally covers low-income adults, children, pregnant women, elderly adults, and people with disabilities.

5. Housing Choice Voucher Program: This program, also known as Section 8, helps low-income individuals and families obtain safe and affordable housing. Participants receive rental subsidies that allow them to find suitable housing in the private rental market.

Benefits to Help Improve Financial Situation

Accessing these assistance programs can have significant benefits for low-income individuals and families, helping improve their financial situation and overall well-being. Here are some of the benefits:

1. Financial Relief: Government assistance programs provide much-needed financial support to help meet basic needs. This can alleviate the financial strain faced by low-income individuals, allowing them to allocate resources towards essential expenses such as food, housing, and healthcare.

2. Access to Education and Training: Some programs, like Head Start, not only provide early childhood education but also offer support for educational opportunities beyond preschool. This can help break the cycle of low income by providing the foundation for future academic and career success.

3. Improved Health and Well-being: Medicaid and programs like LIHEAP indirectly contribute to improved health outcomes by ensuring low-income individuals have access to healthcare and adequate housing. This can lead to better physical and mental well-being, reducing the impact of financial stress on overall health.

4. Increased Employment Opportunities: Through vocational training programs and career counseling services, government assistance programs can help low-income individuals gain new skills and access higher-paying job opportunities. This can lead to increased earning potential and long-term financial stability.

5. Social and Community Support: Participation in government assistance programs can provide individuals and families with a sense of belonging and support from their community. These programs often connect individuals to local resources and services, fostering a supportive network that can assist in times of need.

It is essential for individuals to explore the available assistance programs and benefits to determine which ones they qualify for and how they can best utilize them to improve their financial situation. By accessing these programs and taking advantage of the benefits they offer, low-income individuals can work towards achieving financial stability and a better quality of life.

Aid for Low-Income Families

Support Programs for Families

Low-income families often face numerous challenges in meeting their basic needs and achieving financial stability. To provide support and alleviate some of these difficulties, various government programs and community resources are available. Here are some key support programs for low-income families:

– Head Start: Head Start is a federal program that offers early childhood education, health, and nutrition services to low-income children and their families. By providing comprehensive support, Head Start aims to promote school readiness and enhance the overall well-being of children from disadvantaged backgrounds.

– Supplemental Nutrition Assistance Program (SNAP): Formerly known as food stamps, SNAP helps eligible low-income individuals and families afford nutritious food. Participants receive an Electronic Benefit Transfer (EBT) card that can be used at authorized grocery stores, supermarkets, and farmers markets.

– Medicaid: Medicaid is a joint federal and state program that provides health insurance to low-income individuals and families. It covers a wide range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care.

– Temporary Assistance for Needy Families (TANF): TANF is a federal assistance program that aims to provide temporary financial support and work opportunities to low-income families. It offers cash assistance, job training, and other supportive services to help individuals transition into self-sufficiency.

– Child Care and Development Fund (CCDF): The CCDF provides funds to states to help low-income families afford child care while parents are working or pursuing education or training. This program assists families in accessing safe and affordable child care services, allowing parents to maintain employment or participate in education programs.

Resources for Financial Assistance

In addition to government programs, there are various community resources and organizations that offer financial assistance and support to low-income families. These resources can provide additional help in meeting basic needs and improving financial stability. Here are some examples:

– Local Community Action Agencies: Community Action Agencies (CAAs) are nonprofit organizations that focus on reducing poverty and providing support to low-income individuals and families. They offer a range of services, including emergency assistance, utility bill payment assistance, job training, and housing programs.

– Nonprofit Organizations: Many nonprofit organizations provide targeted assistance to specific needs of low-income families. These organizations may offer services such as free or low-cost medical care, mental health support, educational resources, and housing assistance.

– Financial Counseling and Education: Some organizations offer financial counseling and education programs to help low-income families improve their financial literacy and develop strategies for budgeting, managing debt, and long-term financial planning.

– Scholarship and Education Grant Programs: Various scholarships and education grants are available to low-income students seeking higher education. These financial resources can help reduce the financial burden of tuition fees and other educational expenses.

– Job Training Programs: Job training programs aim to enhance the skills and qualifications of individuals, making them more competitive in the job market. These programs often partner with local businesses and industries to provide training in high-demand fields.

By utilizing these support programs and resources, low-income families can alleviate some of the challenges they face and strive towards economic stability. It is important for families in need to explore and access the available assistance to improve their overall well-being and create a brighter future for themselves and their children.

State-Specific Low Income Programs

Overview of State Programs

In addition to federal assistance programs, many states have implemented their own initiatives to support low-income families. These state-specific programs aim to address the unique needs and challenges faced by residents in each state. While the specific programs and eligibility criteria may vary, the overall goal is to provide financial assistance and resources to those in need.

State programs often work in conjunction with federal programs, filling gaps and providing additional support where necessary. They may also offer specialized services tailored to local communities. It is important for individuals and families to be aware of the state-specific programs available to them, as they can provide valuable assistance beyond what is offered at the federal level.

Examples of State Assistance Initiatives

* California’s CalWORKs program: California’s CalWORKs program provides support to low-income families with children. It offers cash aid, employment services, and other resources to help families achieve self-sufficiency. The program also offers child care assistance, transportation support, and domestic violence services.

* New York’s Home Energy Assistance Program (HEAP): HEAP assists low-income households with their energy costs, including heating and cooling bills. The program provides financial assistance to eligible individuals and families, helping them to stay warm during the winter months and cool during the summer.

* Texas’ Children’s Health Insurance Program (CHIP): CHIP offers affordable health insurance coverage for children in low-income families who do not qualify for Medicaid. The program provides comprehensive health care services, including doctor visits, prescriptions, vaccinations, and dental care.

* Florida’s Low Income Home Energy Assistance Program (LIHEAP): LIHEAP helps eligible low-income households with their energy bills, providing financial assistance to cover heating and cooling costs. The program also offers weatherization services to improve energy efficiency in homes.

* Illinois’ Illinois Job Training Program (IJTP): IJTP is a state-funded program that provides job training and employment services to low-income individuals. The program offers vocational training, career counseling, and job placement assistance, helping participants develop skills and find employment in high-demand industries.

It is important to note that these examples represent just a fraction of the state-specific programs available across the United States. Each state may have its own unique initiatives and resources designed to support low-income families.

By utilizing state-specific programs in addition to federal assistance, individuals and families can access a wider range of support services tailored to their specific needs. These programs can significantly impact financial stability and overall well-being, providing crucial resources that can help families on their path to self-sufficiency.

Calculating Low Monthly Income

Factors Affecting Low Monthly Income

When determining low monthly income, several factors come into play. These factors can vary depending on the federal, state, or local government agency or advocacy organization. Here are some considerations:

– Family Size: The number of people in a household plays a significant role in calculating low monthly income. Larger households may have higher income thresholds due to the increased cost of living.

– Geographic Location: The cost of living varies across different regions and states. Low monthly income thresholds may be adjusted to account for these differences, ensuring that individuals and families receive adequate support based on their location.

– Multiplier Guidelines: Some programs use a multiplier guideline to define low income. For example, the Federal Poverty Level (FPL) can be multiplied by 125%, 150%, or 185% to determine income eligibility. These multipliers take into account higher living expenses and provide assistance to a broader range of individuals and families.

– Other Income Sources: When assessing low monthly income, certain programs may consider all sources of income, including wages, self-employment earnings, retirement benefits, and disability payments. This comprehensive approach ensures a more accurate representation of a family’s financial situation.

Determining Income Eligibility

The process of determining income eligibility for low-income programs typically involves comparing an individual or family’s income to the applicable income thresholds. These thresholds are set by the specific program and may vary based on factors such as family size and geographic location.

To determine eligibility, individuals and families may need to provide documentation of their income, such as pay stubs, tax returns, or bank statements. Some programs also consider other factors like assets, expenses, and household composition when assessing eligibility.

It is worth noting that income eligibility criteria may change over time as laws and regulations are updated. Therefore, it is important for individuals and families to stay informed about the specific requirements of the programs they are interested in.

Overall, calculating low monthly income involves considering various factors that can influence eligibility for assistance programs. By understanding these factors and providing the necessary documentation, individuals and families can access the support they need to improve their financial circumstances and create a brighter future.

Strategies for Managing Low Monthly Income

Budgeting and Financial Planning Tips

When dealing with low monthly income, it is crucial to have effective budgeting and financial planning strategies in place. Here are some tips to help individuals and families make the most of their limited resources:

– Create a Monthly Budget: Start by tracking all income and expenses to determine where the money is going. Then, allocate a specific amount for essential needs such as housing, utilities, groceries, and transportation. Consider using budgeting tools or apps to stay organized and monitor spending.

– Prioritize Essential Expenses: When money is tight, it is important to distinguish between wants and needs. Focus on covering necessary expenses first, such as rent or mortgage payments, food, and healthcare. Non-essential items and leisure activities may need to be reduced or eliminated temporarily until financial stability improves.

– Seek Financial Education and Support: Many organizations and community centers offer free or low-cost financial education classes and workshops. These resources can provide valuable information on managing money, setting financial goals, and building credit. Additionally, consider reaching out to local social service agencies for assistance programs that can provide support for specific needs, such as utility bill payment assistance or food pantries.

Maximizing Income and Minimizing Expenses

In addition to budgeting, there are other strategies that can help individuals and families make the most of their income while minimizing expenses:

– Explore Additional Income Opportunities: Consider exploring side jobs or freelance work that can bring in extra income. This could include freelancing, gig economy jobs, or selling crafts or goods online. Additionally, individuals can look into government assistance programs that provide job training and employment opportunities to low-income individuals.

– Save on Housing Costs: Housing expenses can often be one of the largest components of a budget. Consider downsizing to a smaller, more affordable living space or exploring housing assistance programs. Renters may also be able to negotiate lower rent or request repairs to reduce expenses.

– Cut Back on Utility Costs: Lowering utility costs can free up valuable funds for other necessities. Simple changes such as unplugging electronics when not in use, setting thermostats to energy-saving temperatures, and using energy-efficient light bulbs can make a significant difference in monthly utility bills.

– Limit Non-Essential Expenses: Evaluate discretionary spending habits and identify areas where expenses can be reduced. This may include limiting dining out, entertainment, and unnecessary subscriptions. Shop smart by comparing prices and looking for sales or discounts when making purchases.

By implementing these strategies and making proactive financial decisions, individuals and families with low monthly income can better manage their finances and work towards a more secure financial future. It is important to remember that even small changes can add up and make a significant difference in financial well-being.

Resources for Low-Income Individuals

Non-Profit Organizations and Charities

There are several non-profit organizations and charities that offer resources and support to low-income individuals and families. These organizations aim to alleviate poverty and provide assistance in various areas, including housing, food, healthcare, education, and employment. Here are some notable organizations:

– The Salvation Army: Known for its comprehensive range of services, The Salvation Army provides emergency assistance, affordable housing, meal programs, job training, and rehabilitation services to individuals and families in need.

– Feeding America: As the largest hunger-relief organization in the United States, Feeding America operates a network of food banks and partner agencies that distribute food to those facing hunger. They also provide resources and support for long-term solutions to food insecurity.

– Habitat for Humanity: This organization helps low-income families build and own affordable homes. Through volunteer labor and donations, Habitat for Humanity offers a pathway to homeownership for those in need of decent and affordable housing.

– United Way: The United Way network is a global movement that works to improve lives by mobilizing communities to address critical issues like education, income, and health. They offer a variety of programs and services that support low-income individuals and families.

Online Platforms and Forums for Financial Support

In addition to non-profit organizations and charities, there are online platforms and forums that can connect low-income individuals with financial support and resources. These platforms provide a space for individuals to seek assistance, share advice, and access information on available resources. Here are some examples:

– ModestNeeds.org: This online platform connects individuals and families experiencing financial setbacks with donors who can provide assistance. People can submit their needs and request funding for essential expenses, such as rent, medical bills, or car repairs.

– 211.org: 211 is a nationwide resource that connects individuals with local services and programs in their community. By dialing 211 or visiting the website, individuals can access information and referrals for a wide range of assistance, including food, housing, healthcare, and employment support.

– Reddit Personal Finance and Assistance Subreddits: Reddit has various communities dedicated to personal finance and assistance, where individuals can seek advice, share their stories, and find helpful resources. Subreddits like r/personalfinance and r/Assistance provide a platform for people to connect and receive support.

These resources and platforms can provide invaluable support to low-income individuals and families, helping them improve their financial situation and access the assistance they need. It’s important for individuals to reach out and take advantage of these resources to help navigate and overcome financial challenges.

Conclusion

Importance of Seeking Help and Utilizing Available Programs

When facing financial challenges on a low monthly income, it is crucial to seek help and utilize the available programs and resources. Many non-profit organizations, charities, and online platforms offer assistance and support to low-income individuals and families. By reaching out to these resources, individuals can access housing, food, healthcare, education, and employment opportunities that can help improve their financial situation.

These programs, such as The Salvation Army, Feeding America, Habitat for Humanity, United Way, ModestNeeds.org, and 211.org, strive to alleviate poverty and provide long-term solutions to financial instability. They offer a range of services, including emergency assistance, affordable housing, meal programs, job training, and financial aid for essential expenses.

In addition to seeking help from organizations, individuals can also join online platforms and forums like Reddit’s personal finance and assistance subreddits. These platforms provide a space for individuals to connect, seek advice, share their stories, and find helpful resources. By engaging in these communities, individuals can find support and guidance from others who have faced similar challenges.

Steps to Improve Financial Situation on a Low Monthly Income

While seeking assistance is important, there are also steps individuals can take to improve their financial situation on a low monthly income. Here are a few suggestions:

– Budgeting: Creating a budget helps individuals understand their income and expenses. By tracking their spending and identifying areas to cut back, individuals can better manage their finances and allocate funds towards savings or necessary expenses.

– Increasing income: Exploring opportunities for increasing income, such as taking on a part-time job, freelancing, or pursuing additional education or training can help individuals augment their monthly earnings and improve their financial stability.

– Seeking education and training: Investing in education or acquiring new skills can open up better job prospects and increase earning potential. Many programs and scholarships are available to help low-income individuals access education and training opportunities.

– Building an emergency fund: Setting aside a portion of income for emergencies can provide a safety net during unexpected financial setbacks. Even small amounts saved regularly can accumulate over time and provide peace of mind.

– Accessing public assistance programs: Utilizing public assistance programs like Medicaid, SNAP (Supplemental Nutrition Assistance Program), or subsidized housing can provide additional support in meeting essential needs, allowing individuals to allocate more of their income towards other expenses.

By combining these steps with the support of available programs and resources, individuals can take control of their financial situation and work towards long-term stability.

Remember, reaching out for help is not a sign of weakness but a proactive step towards improving one’s financial well-being. Seek support from the listed programs, non-profit organizations, charities, and online platforms to access the resources and assistance needed to overcome financial challenges.