Introduction

Definition and criteria for low income

Low income is generally defined as an economic status in which an individual or family earns a limited amount of money, making it difficult to meet the basic needs of living. The exact criteria for determining low income can vary depending on various factors like location, family size, and government regulations. In the case of affordable housing and rental assistance programs, the U.S. Department of Housing and Urban Development (HUD) sets income limits to determine eligibility.

To qualify for affordable housing or rental assistance programs offered in Travis County, applicants must meet these income requirements. These income limits not only establish eligibility but also determine the level of assistance that a family may receive. It is crucial to understand and consider these limits when applying for these programs.

Overview of the importance of understanding low income

Understanding low income is essential for both individuals and organizations involved in providing affordable housing and rental assistance programs. Here are some key reasons why understanding low income is important:

1. Ensuring access to affordable housing: By understanding the income levels of individuals and families, organizations can better allocate resources and design programs that meet the specific needs of low-income households. This helps ensure that individuals and families have access to safe and affordable housing options.

2. Promoting financial stability: Understanding low income allows organizations to develop support services and initiatives that promote financial stability among low-income individuals and families. This may include financial education, job training, and childcare assistance, among other services. By addressing the underlying financial challenges, these programs aim to help individuals and families move towards self-sufficiency.

3. Guiding policy and decision-making: Accurate data on low income helps inform policymakers and government agencies in developing effective policies and allocating resources. By understanding the income thresholds and trends, policymakers can implement targeted programs and policies that address the specific challenges faced by low-income individuals and families.

4. Creating inclusive communities: Understanding low income is crucial for building inclusive communities that support the well-being of all residents. By providing affordable housing options and rental assistance programs, communities can help prevent homelessness and ensure that individuals and families of diverse backgrounds can access vital resources and opportunities.

In conclusion, understanding low income is vital for individuals and organizations involved in providing affordable housing and rental assistance programs. By considering income limits and tailoring programs based on the needs of low-income individuals and families, we can work towards ensuring access to safe and affordable housing for all.

HUD Income Limits

Explanation of HUD income limits

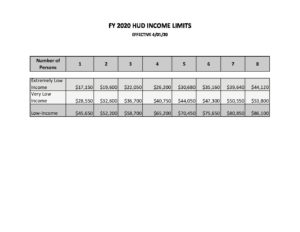

The U.S. Department of Housing and Urban Development (HUD) establishes income limits to determine eligibility for their affordable housing and rental assistance programs. These income limits are designed to help low-income families find safe and affordable housing in Travis County. The limits vary for each property, and you can find the specific limits for each property on the corresponding property page.

How HUD income limits are determined

HUD calculates income limits based on the median income for the area and the family size. They take into consideration factors such as the number of family members, the county the property is located in, and the income distribution for the specific area. The income limits are updated annually to reflect changes in the local economy and the cost of living.

To determine if you qualify for HUD’s affordable housing or rental assistance programs, you can refer to the HUD income limits table. The table outlines the income limits based on family size and provides information on the maximum income allowed for eligibility. By comparing your household income to the income limits, you can determine if you meet the requirements to qualify for assistance.

Update frequency and relevance of HUD income limits

HUD income limits are updated annually to ensure they remain relevant to the current economic conditions. The updates take into account changes in the area’s median income, inflation, and other factors that may affect housing affordability. These updates are necessary to accurately determine eligibility for HUD’s programs and to ensure that assistance is provided to those who need it most.

It is important to regularly check the HUD income limits table to stay informed about any changes that may affect your eligibility for affordable housing or rental assistance. By keeping up to date with the income limits, you can ensure that you are aware of any opportunities for assistance that may become available.

In conclusion, HUD income limits play a crucial role in determining eligibility for affordable housing and rental assistance programs. By understanding how these limits are calculated and staying informed about updates, individuals and families can take advantage of available resources to find safe and affordable housing in Travis County.

CDBG Income Limits

Explanation of CDBG income limits

The CDBG income limits are used to determine eligibility for receiving services funded by the Community Development Block Grant (CDBG) program. These limits are established by the U.S. Department of Housing and Urban Development (HUD) and are specific to the Austin-Round Rock Metropolitan Statistical Area (MSA) in Travis County. The income limits are designed to ensure that assistance is provided to households with low to moderate incomes.

Relationship between CDBG income limits and HUD income limits

It is important to note that the CDBG income limits are directly related to the HUD income limits. The CDBG Low Income limit corresponds to the Section 8 Very Low Income (50%) limit, while the CDBG Moderate Income limit corresponds to the Section 8 Low Income (80%) limit. This means that the eligibility criteria for CDBG-funded services are aligned with the income limits set by HUD for their affordable housing programs.

Specifics of using CDBG income limits for low-income purposes

The CDBG income limits are intended to be used exclusively for determining eligibility for CDBG-funded services in Travis County. These limits take into account factors such as family size and the area’s median income to determine the maximum income allowed for eligibility. It is essential for individuals and families to compare their household income to these limits to determine if they qualify for assistance.

To ensure accuracy and relevance, the CDBG income limits are updated annually to reflect changes in the local economy and the cost of living. By regularly checking the updated income limits, individuals can stay informed about any changes that may affect their eligibility for CDBG-funded services. This helps ensure that assistance is provided to those who need it most.

In summary, the CDBG income limits are an important tool for determining eligibility for receiving CDBG-funded services. Through their alignment with the HUD income limits, these limits help ensure that assistance is provided to low to moderate-income households in Travis County. Regularly checking the updated income limits helps individuals and families stay informed about any changes that may affect their eligibility. This allows them to take advantage of available resources to access safe and affordable housing in the community.

Federal Poverty Guidelines

Introduction to the federal poverty guidelines

The federal poverty guidelines are used to determine income eligibility for various programs, including affordable housing and rental assistance. These guidelines are set by the U.S. Department of Health and Human Services and are updated annually. They are based on household size and income, and they help to ensure that assistance is targeted towards individuals and families who are considered low-income.

Explanation of how federal poverty guidelines determine low income

The federal poverty guidelines determine low income by comparing an individual or family’s income to the set threshold for their household size. If the income falls below the poverty guideline, they are considered to be low-income. These guidelines take into account factors such as the number of people living in a household and the gross income earned by the household.

Comparison of federal poverty guidelines with other income thresholds

The federal poverty guidelines are just one of several income thresholds used to determine eligibility for assistance programs. Other income thresholds include the median family income (MFI) and the area median income (AMI). While the federal poverty guidelines focus on the lowest-income individuals and families, MFI and AMI consider a broader range of income levels.

Here is a comparison of the federal poverty guidelines with the MFI and AMI:

| Threshold | Focus | Calculation Method |

| ———————- | ———————————— | ————————————– |

| Federal Poverty | Lowest-income individuals and families | Based on household size and gross income |

| Guidelines | | |

| Median Family Income | Broader range of income levels | Based on the median income for the area |

| (MFI) | | |

| Area Median Income | Broader range of income levels | Based on the median income for the area |

It is important to note that these income thresholds can vary depending on the program and the specific location. Different programs may have different criteria for determining eligibility and assistance levels.

In conclusion, the federal poverty guidelines are an important tool for determining income eligibility for various assistance programs. Understanding how these guidelines work and how they compare to other income thresholds can help individuals and families determine their eligibility and access the support they need.

Median Family Income

Definition and significance of median family income

Median family income (MFI) is a key measure used to assess income levels in a given area. It represents the midpoint of all family incomes within a specific geographic location, with half of the incomes falling below and half above this threshold. MFI is an essential indicator for determining eligibility and assistance levels for various programs, including affordable housing and rental assistance.

Overview of how median family income is calculated

To calculate the median family income, data is collected from households within a designated area. This data includes the income of all family members, regardless of their age or employment status. The incomes are then sorted from lowest to highest, and the income in the middle of the distribution is identified as the median. This provides an accurate representation of the income level that separates the higher and lower earning families in a given area.

Example of median family income in a specific area (Travis County, FY 2023)

In Travis County, the median family income for the fiscal year 2023 is an essential factor in determining eligibility for affordable housing and rental assistance programs. As of June 15, 2023, the MFI for a family of four in Travis County is $91,200. This means that households with an income below this threshold may qualify for assistance programs aimed at low-income families. It is important to note that the MFI can vary depending on household size and the specific location.

The MFI plays a crucial role in assessing the income levels of families and individuals and determining their eligibility for various assistance programs. Understanding the concept and calculation of MFI is vital for individuals seeking affordable housing and rental assistance, as it provides an objective measure of their income in comparison to others in the area.

In conclusion, median family income is an important indicator used in assessing income levels and determining eligibility for assistance programs. It provides a measure of a family’s income compared to others in a specific geographic area, helping to ensure that assistance is targeted towards those who are considered low-income. By understanding the significance of median family income and how it is calculated, individuals and families can navigate the eligibility criteria and access the necessary support for safe and affordable housing.

Income Limits by Family Size

Explanation of how income limits vary with family size

Income limits for affordable housing and rental assistance programs are determined based on family size. The larger the family, the higher the income limit. This is because larger families typically have higher expenses and may require more assistance to afford safe and affordable housing.

Illustration of income limits for different family sizes using the 2024 Federal Poverty Guidelines

The following table illustrates the income limits for different family sizes based on the 2024 Federal Poverty Guidelines:

| Family Size | Income Limit |

| ———– | ———— |

| 1 | $12,880 |

| 2 | $17,420 |

| 3 | $21,960 |

| 4 | $26,500 |

| 5 | $31,040 |

| 6 | $35,580 |

| 7 | $40,120 |

| 8 | $44,660 |

For families with more than eight members, an additional $4,540 is added to the income limit for each additional person.

These income limits are used to determine eligibility for affordable housing and rental assistance programs. If your annual household income falls within these limits, you may qualify for the programs and receive the level of assistance determined by your income.

It’s important to note that income limits can vary each year and may be adjusted based on changes in the cost of living. Therefore, it’s essential to refer to the current income limits for accurate eligibility information.

By understanding the income limits for your family size, you can assess whether you meet the criteria for affordable housing or rental assistance programs. These programs are designed to help low-income families find safe and affordable housing, providing them with a stable foundation for a better quality of life.

Remember, each program may have its own specific eligibility requirements, so it’s important to review the criteria of each program you are interested in to determine if you meet all the necessary qualifications.

In conclusion, income limits play a crucial role in determining eligibility for affordable housing and rental assistance programs. By comparing your annual household income to the income limits specific to your family size, you can determine if you qualify for these programs and the level of assistance you may receive. This information is invaluable for low-income families who are actively seeking safe and affordable housing in Travis County. So, if you are in need of assistance, make sure to refer to the income limits and requirements set by the relevant programs to determine your eligibility.

Examples of Low-Income Thresholds

Specific income limits for different family sizes

Income limits for affordable housing and rental assistance programs vary depending on the size of the family. Here are some examples of specific income limits based on family size:

– For a family of one, the income limit is $12,880.

– For a family of two, the income limit is $17,420.

– For a family of three, the income limit is $21,960.

– For a family of four, the income limit is $26,500.

– For a family of five, the income limit is $31,040.

– For a family of six, the income limit is $35,580.

– For a family of seven, the income limit is $40,120.

– For a family of eight, the income limit is $44,660.

It’s important to note that for families with more than eight members, an additional $4,540 is added to the income limit for each additional person.

Comparison of low-income thresholds with median family income and federal poverty guidelines

When discussing low-income thresholds, it’s helpful to compare them with the median family income and the federal poverty guidelines. This provides a broader perspective on income levels and the assistance needed for affordable housing.

The median family income represents the midpoint of all incomes in a given area. It is used to determine economic conditions and income disparities. On the other hand, the federal poverty guidelines are used to determine eligibility for various federal programs and assistance.

While the income limits for affordable housing and rental assistance programs are based on family size, comparing them to the median family income and federal poverty guidelines can help put them into context:

– The income limit for a single person is $12,880, which is below the median family income but above the federal poverty guideline for a single person ($12,880 vs $12,880).

– The income limit for a family of four is $26,500, which is below both the median family income and the federal poverty guideline for a family of four ($26,500 vs $66,514 and $26,500 vs $26,500, respectively).

This comparison highlights the challenges faced by low-income families and the need for affordable housing and rental assistance programs to bridge the gap between income and living expenses.

In conclusion, income limits are crucial for determining eligibility and the level of assistance for low-income families seeking affordable housing and rental assistance programs. By understanding the specific income limits for different family sizes and comparing them to the median family income and federal poverty guidelines, individuals can assess their eligibility and access the support they need. These programs aim to provide safe and affordable housing options, helping low-income families build a stable foundation for a better quality of life. It’s important to stay informed about current income limits and program requirements, as they may change over time. If you are in need of assistance, referring to the income limits and requirements set by the relevant programs is a vital step in determining your eligibility and accessing the support you need.

Impact on Housing

How low-income thresholds affect access to housing

Low-income thresholds, as determined by the income limits set by the U.S. Department of Housing and Urban Development (HUD), play a significant role in determining access to housing for low-income families. These income limits determine whether a family is eligible for affordable housing or rental assistance programs, and the level of assistance they may receive. By setting income limits based on family size, HUD aims to provide support to those who need it the most.

For families whose annual household income falls within the income limits, they have the opportunity to apply for affordable housing or rental assistance programs. These programs provide a lifeline for low-income families, who may otherwise struggle to find safe and affordable housing options. By offering a level of assistance corresponding to the income level, these programs help bridge the affordability gap and enable families to secure a stable and suitable home.

Challenges faced by low-income families in finding safe and affordable housing

Low-income families often face significant challenges when searching for safe and affordable housing. The high cost of housing, coupled with limited financial resources, can make it incredibly difficult to find suitable options within their means. Rental prices in many areas often exceed what low-income families can afford, and affordable housing options are limited and in high demand.

Furthermore, affordable housing units may have long waiting lists, making it challenging for families to secure a place to live in a timely manner. This can lead to housing instability and the need to rely on temporary or inadequate housing arrangements. The lack of stable, affordable housing can have adverse consequences on families, impacting their overall well-being and economic opportunities.

Importance of addressing low-income housing needs

Addressing the housing needs of low-income families is essential for several reasons. Firstly, safe and affordable housing is a basic human right, and everyone deserves access to a decent place to live. By providing affordable housing options, we can help create more equitable communities where everyone has the opportunity to thrive.

Additionally, stable housing plays a crucial role in promoting economic stability and upward mobility. Affordable housing allows families to allocate their financial resources towards other essential needs, such as healthcare, education, and saving for the future. This, in turn, helps break the cycle of poverty and build a stronger foundation for future generations.

Moreover, ensuring low-income families have access to safe and affordable housing contributes to community development and social cohesion. When families have stable homes, they are more likely to invest in their neighborhoods, participate in community activities, and foster a sense of belonging. This, in turn, strengthens the fabric of the community and creates a more vibrant and inclusive society.

In conclusion, income limits have a significant impact on housing access for low-income families. By setting income thresholds, affordable housing and rental assistance programs aim to provide support to those who need it most. However, low-income families still face many challenges in finding safe and affordable housing. Addressing these housing needs is crucial, as it is not only a matter of social justice but also has wide-ranging benefits for individuals, families, and communities as a whole. By working towards increasing affordable housing options and addressing the housing needs of low-income families, we can build a stronger and more inclusive society.**Conclusion**

**Summary of the concept of low income**

Low-income thresholds, as determined by the income limits set by the U.S. Department of Housing and Urban Development (HUD), play a significant role in determining access to housing for low-income families. These income limits determine eligibility for affordable housing or rental assistance programs and the level of assistance a family may receive. By setting income limits based on family size, HUD aims to provide support to those who need it the most.

**Importance of understanding and addressing low-income issues**

Addressing the housing needs of low-income families is essential for several reasons. Firstly, safe and affordable housing is a basic human right, and everyone deserves access to a decent place to live. By providing affordable housing options, we can help create more equitable communities where everyone has the opportunity to thrive.

Additionally, stable housing plays a crucial role in promoting economic stability and upward mobility. Affordable housing allows families to allocate their financial resources towards other essential needs, such as healthcare, education, and saving for the future. This, in turn, helps break the cycle of poverty and build a stronger foundation for future generations.

Moreover, ensuring low-income families have access to safe and affordable housing contributes to community development and social cohesion. When families have stable homes, they are more likely to invest in their neighborhoods, participate in community activities, and foster a sense of belonging. This, in turn, strengthens the fabric of the community and creates a more vibrant and inclusive society.

**In conclusion**, income limits have a significant impact on housing access for low-income families. By setting income thresholds, affordable housing and rental assistance programs aim to provide support to those who need it most. However, low-income families still face many challenges in finding safe and affordable housing. Addressing these housing needs is crucial, as it is not only a matter of social justice but also has wide-ranging benefits for individuals, families, and communities as a whole. By working towards increasing affordable housing options and addressing the housing needs of low-income families, we can build a stronger and more inclusive society.